in Shaping the Indian Stock Market

Reliance Industries Limited (RIL) is not just another name in the Indian corporate landscape; it’s a behemoth that has significantly shaped the contours of India’s economy and, by extension, the stock market. Understanding the influence of Reliance Industries on the stock market is essential for any investor, market analyst, or economic enthusiast who wishes to grasp the nuances of India’s financial ecosystem.

The Foundation and Evolution of Reliance Industries

Founded by Dhirubhai Ambani in 1966, Reliance Industries started as a small textile company. Today, it has metamorphosed into a colossal conglomerate with diversified interests spanning petrochemicals, refining, oil, telecommunications, retail, and digital services. This journey from a modest business to a multi-billion dollar corporation is a testament to strategic vision, relentless ambition, and a keen understanding of market dynamics.

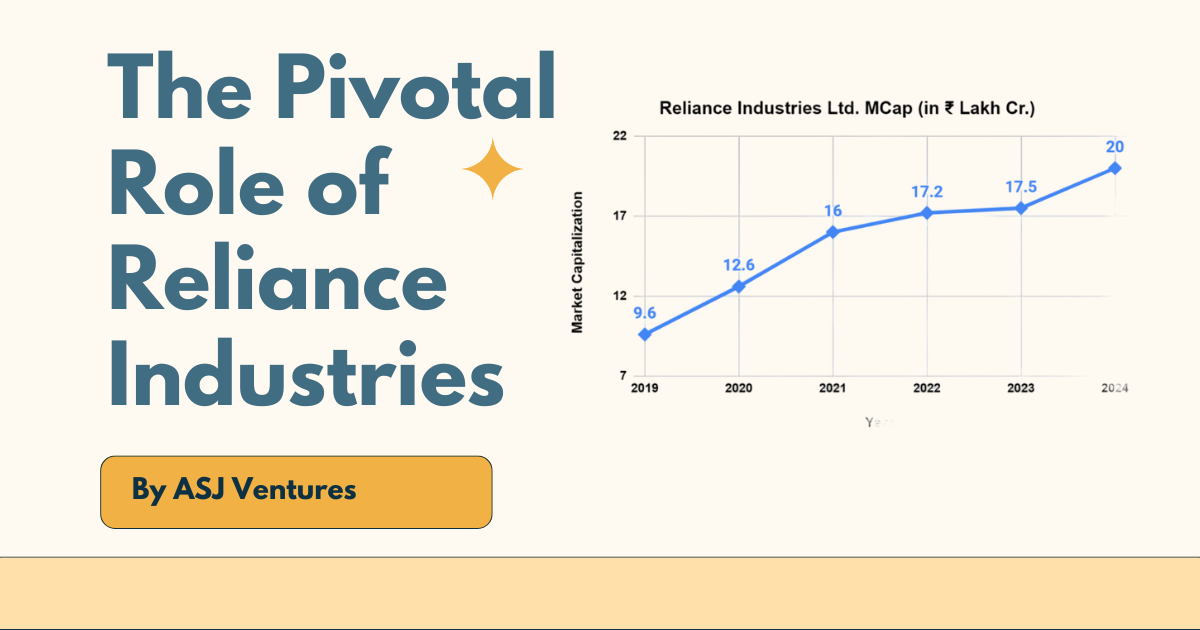

Market Capitalization: A Giant Among Giants

Reliance Industries has consistently ranked among the top companies in India by market capitalization. In fact, it has often held the position of the most valuable company in the Indian stock market. This sheer size means that any significant movement in Reliance’s stock price can sway the broader market indices, such as the Nifty 50 and the Sensex.

For instance, when Reliance announced its plan to become net debt-free in 2020 through a series of strategic investments and partnerships, the market responded with a surge in its stock price, lifting the entire market sentiment. This reflects the weight Reliance carries within the market—its performance can dictate market trends.

Strategic Diversification and Its Impact on the Market

One of the key factors behind Reliance’s influence on the stock market is its strategic diversification. The company has not only excelled in its core businesses of petrochemicals and refining but has also made significant strides in newer sectors like telecommunications and retail.

- Telecommunications: The launch of Reliance Jio in 2016 was a game-changer for the Indian telecom sector. Jio’s aggressive pricing strategy, coupled with its high-quality services, disrupted the industry, leading to a consolidation of market players. This move also had a ripple effect on the stock market. The entry of Jio resulted in a steep rise in Reliance’s stock price, which in turn bolstered the broader market indices.

- Retail: Reliance Retail, another arm of the conglomerate, has been on an acquisition spree, expanding its footprint across the country. As the retail sector grows, so does the valuation of Reliance Industries. This growth story adds another layer of strength to Reliance’s stock, making it a favorite among investors and a key driver of market sentiment.

Reliance and Global Partnerships: A Catalyst for Market Movements

Reliance’s influence on the stock market is also magnified by its strategic global partnerships. These partnerships not only bring in capital but also enhance the company’s technological capabilities, ensuring it stays ahead of the curve.

For example, the series of investments made by global giants like Facebook, Google, and Saudi Aramco into Reliance’s various arms sent ripples through the stock market. Each announcement of a new partnership typically leads to a surge in Reliance’s stock price, which, due to the company’s large weighting in market indices, often leads to broader market gains.

The Reliance Factor in Market Sentiment

Reliance Industries’ ability to influence market sentiment is unparalleled in the Indian context. This influence stems not just from its market capitalization but also from the perception that Reliance is a bellwether for the Indian economy. When Reliance performs well, it’s seen as a sign that the broader economy is on the right track, and vice versa.

Moreover, Reliance’s announcements, whether related to earnings, new ventures, or partnerships, are closely watched by investors. Positive news can lead to a market rally, while negative news can lead to a market dip, underscoring the critical role Reliance plays in shaping market sentiment.

Reliance’s Stock as a Reflection of Economic Health

Investors often look at Reliance’s stock performance as a proxy for the health of the Indian economy. The company’s diversified portfolio means that it is exposed to various sectors, making its stock performance a good indicator of broader economic trends.

For instance, during the COVID-19 pandemic, while many sectors struggled, Reliance’s pivot towards digital services and e-commerce through Jio and Reliance Retail helped it weather the storm better than most. This resilience was reflected in its stock price, which not only recovered quickly but also reached new highs, signaling to investors that Reliance was a safe bet in uncertain times.

Conclusion: The Unshakable Influence of Reliance Industries

In the realm of the Indian stock market, Reliance Industries stands as a titan whose every move is scrutinized by investors, analysts, and regulators alike. Its influence is not merely a function of its size but also of its strategic acumen, its ability to pivot, and its vision for the future.

As India continues to grow as a global economic power, Reliance Industries will undoubtedly play a crucial role in shaping that trajectory. For investors, keeping an eye on Reliance is not just advisable—it’s essential for understanding the broader market dynamics. In many ways, the story of Reliance is the story of modern India: ambitious, resilient, and always striving for greater heights.

Investing is a journey, and the more informed you are, the better equipped you’ll be to navigate the ups and downs of the market.

Ready to embark on your journey toward financial empowerment? Click “Sign Up” to secure your spot in our upcoming free class and begin your path to becoming a savvy investor!

Disclaimer: This content is intended for educational & informational purposes only and should not be construed as financial advice. We are not responsible for any financial losses incurred based on the information provided. We strongly recommend that readers consult with a qualified financial advisor before making any investment decisions.