The retailing sector can be divided into various categories, depending on the types of products serviced. It covers diverse products such as food, apparel, consumer goods, financial services, and leisure. Growth in the Indian retail industry has been driven by the country’s economic fundamentals over the past few years.

India is a fast-evolving and dynamic consumer market which necessitates the retail industry to be constantly innovative to stay relevant in the market. The growing population and continuous demand are witnessing significant opportunities in the retail industry. Indian markets have been witnessing a change from a need-based industry to a fashion, style, and fitness-oriented industry and it has also the potential to increase its global market share in export. With changing lifestyles and increasing affluence, domestic demand is projected to grow at a faster rate.

The retail industry is also expected to witness intense competition from innovative digital platforms.

The retail industry is also expected to witness intense competition from innovative digital platforms.

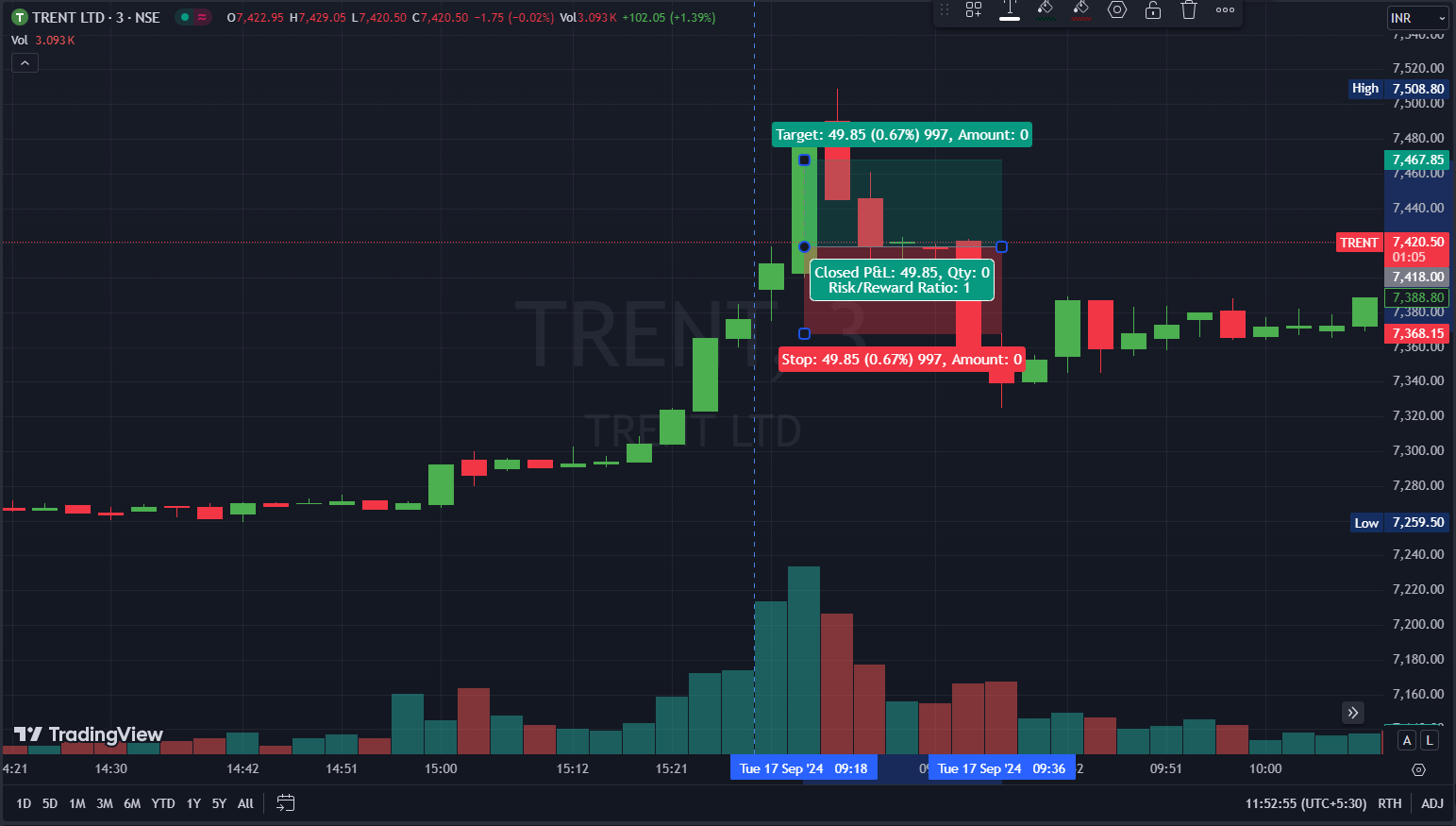

Trent Ltd has been showing strong momentum in recent months, driven by robust earnings and expansion strategies. Following its Q1 2024 results, the stock surged 19% over just six trading sessions, reaching record highs of ₹6,750 per share and approaching the ₹7,000 mark. Analysts have raised their target prices, with some forecasting levels as high as ₹7,136. This optimism is backed by Trent’s aggressive store expansion, especially its Zudio brand, and improved performance across multiple retail segments. Sales growth and revenue per square feet: You can look at the historical sales growth of the company to forecast the future sales of the company. Sales for the current year of Trent is Rs 11,926.56 Cr. The compounded sales growth of the past three years of Trent is 79.93 %.

Operating Margin: This will tell you about the operational efficiency of the company. The operating margin of Trent for the current financial year is 16.54 %.

Current Ratio: This is the working capital ratio that will tell you whether the company is generating enough cash for the working capital requirements. The current ratio of Trent is 1.96 as of this year.

Return Ratios such as Return on Assets (ROA), and Return on Equity (ROE) of Trent are 18.44 % and 38.15 % respectively for the current year. 3-year average ROE is 22.27 %.

Dividend Yield: – It tells us how much dividend we will receive about the price of the stock. The current year dividend for Trent is Rs 3.20 and the yield is 0.04 %.

Trent’s profitability, particularly its impressive growth in same-store sales and gross margin expansion, reflects its strong position in the retail sector (Zudio, Westside, Star Bazar).

Recommended for quick momentum through ATM Call Option.