Chart Patterns and Their Significance

Indicators and Oscillators for Market Timing

Price Action Strategies for Precise Trading

Join ASJ Stock Market Classes and gain expert insights, hands-on training, and real-world strategies to excel in trading.

Students trained and empowered with expert stock market knowledge.

Hidden charges, transparent, affordable pricing for all our stock market courses.

ASJ Stock Market Classes is committed to equipping individuals with the knowledge and skills needed to navigate the stock market confidently. Our expert-led training programs, real-time market insights, and hands-on learning ensure that students gain practical trading experience.

Learn from seasoned traders and market analysts who bring years of experience to help you succeed in the stock market.

Our courses focus on real-world trading strategies, live market analysis, and hands-on practice to ensure you gain practical knowledge.

Whether you're a beginner or an experienced trader, our structured courses are designed to help you achieve financial independence.

Our expert-led courses provide in-depth stock market knowledge, real-time market analysis, and practical trading experience to help you become a confident trader.

Our expert traders and market analysts provide comprehensive training in stock trading, investment strategies, and risk management to help you navigate the financial markets with confidence.

Learn chart patterns, indicators, and price action strategies to make precise trading decisions.

Chart Patterns and Their Significance

Indicators and Oscillators for Market Timing

Price Action Strategies for Precise Trading

Understand financial statements, economic indicators, and valuation models to invest wisely.

Financial Statement Analysis for Investors

Macroeconomic Indicators and Market Impact

Stock Valuation Models for Smart Investing

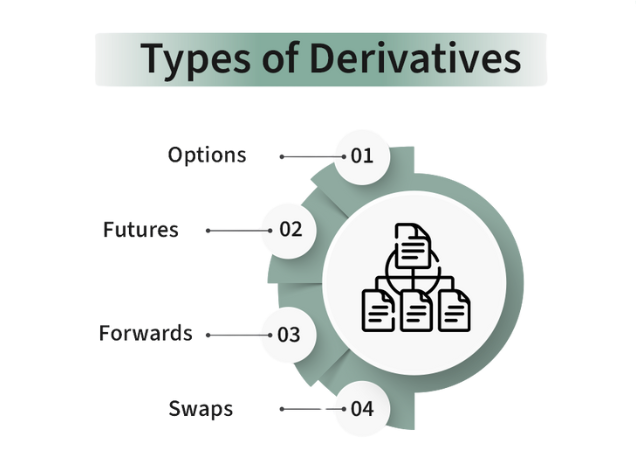

Master options trading strategies, futures, and hedging techniques to maximize profits.

Options Trading Strategies for Every Market Condition

Futures & Hedging Techniques for Risk Management

Greeks & Advanced Options Pricing Models

Develop risk assessment skills and capital management techniques to sustain profitability.

Position Sizing & Risk-Reward Strategies

Stop-Loss & Risk Mitigation Techniques

Psychological Discipline & Risk Control in Trading

Our team of experienced professionals delivers personalized, results-driven financial strategies tailored to your unique goals. We prioritize transparency, trust, and long-term success.

At ASJ Stock Market Classes, we believe that successful investing starts with knowledge. Our approach is built on expert research, strategic market insights, and a commitment to guiding investors toward informed financial decisions.

Explore key insights into the stock market and financial education. Learn how market trends, investor behavior, and trading innovations impact your journey to financial success.

Structured learning modules covering technical analysis, fundamental analysis, and trading strategies.

Hands-on experience with real-time stock market data and live trading simulations.

Learn from seasoned traders and market professionals through interactive sessions, real-world case studies, and in-depth market insights.

Choose from our structured stock market courses designed to enhance your trading skills, whether you're a beginner or an advanced trader.

Beginner Course

Introduction to the stock market, covering fundamental concepts and beginner-friendly strategies.

Intermediate Course

Comprehensive training on stock market operations, technical analysis, and trading strategies.

Advanced Course

Master advanced technical analysis techniques to make informed trading decisions from Beginner to Advanced strategies.

Start your stock market journey with expert guidance. Message us on WhatsApp for course details and enrollment.

Students trained and successfully trading in the stock market.

Based on Google Reviews.

Our classes cover stock market basics, technical & fundamental analysis, trading strategies, risk management, and investment planning.

No, our courses are designed for beginners as well as experienced traders looking to enhance their skills.

The course duration varies. We offer short-term workshops and comprehensive courses that last a few weeks.

Yes, all students receive a certification upon successful completion of the course.

Yes, we conduct live market sessions (Crypto only) where students can learn practical trading strategies in real-time.

Yes, as a franchise partner of Motilal Oswal, we assist students in opening Demat accounts for stock trading and investments.

Explore the basics of stock market investing, including key concepts, terminology, and foundational strategies to get you started on your investment journey.